who pays sales tax when selling a car privately in michigan

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. If a vehicle is purchased privately the sales tax must be paid at a branch when you apply for the Indiana certificate of title.

Car Sales Tax In Michigan Getjerry Com

To calculate how much sales tax youll owe simply multiple the vehicles price by 006625.

. It depends on the length of the permit. Income Tax Liability When Selling Your Used Car. Existing state residents who have purchased an out-of-state vehicle will also be required to pay the 6 percent use tax of the vehicle sale price.

However you should know that you may have to pay a gift tax depending on how much the car is worth. License plates and registrations buyers must visit a motor vehicle service center to register a vehicle for the first time. Michigan collects a 6 state sales tax rate on the purchase of all vehicles.

You would not have to report this to the irs. In a nutshell the Internal Revenue Service IRS views all personal vehicles as capital assets. How much do temporary permits cost.

If i sell my car do i pay taxes. In order to ensure a smooth transition for retailers whose only obligation to collect Michigan sales tax comes from these new standards a remote seller must register and pay the Michigan tax beginning with transactions occurring on or after October 1 2018 or the calendar year after the threshold of over 100000 in Michigan sales or 200 transactions with Michigan customers is. 2018 Taxes and Business Vehicles.

And permits valid 60 days cost 20 of the annual registration fee or 40 whichever is more. However certain states have higher tax rates under certain conditions. Buying a car may be done through a car dealer or from a private seller.

Buying a car or any other motor vehicle is a taxable transaction. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. You can find these fees further down on the page.

The IRS considers all personal vehicles capital assets. Several examples of exceptions to this tax are vehicles which are sold specifically to relatives of the seller certain types of equipment which is used in the agricultural business or some types of industrial machinery. However you do not pay that tax to the car dealer or individual selling the car.

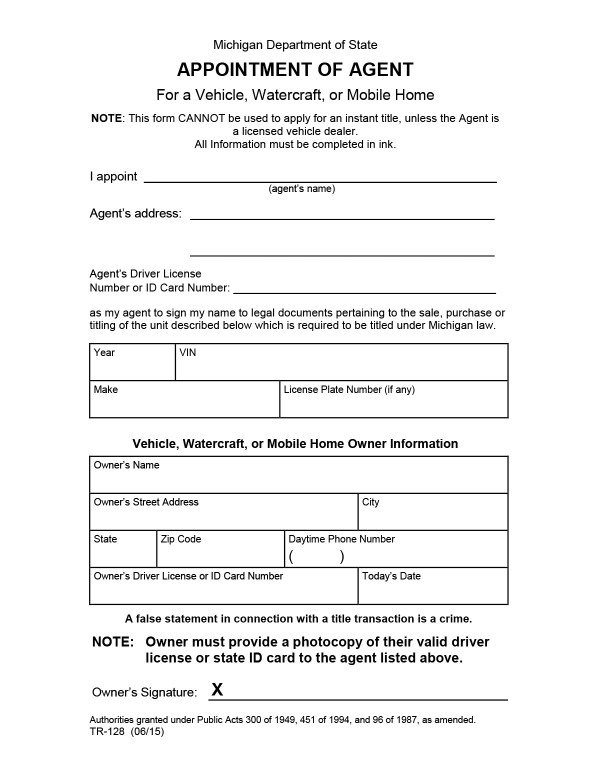

But permits valid 30 days cost 10 of the annual registration fee or 20 whichever is higher. Who Pays Sales Tax When Selling A Car Privately In Florida Form 1181E Download Fillable PDF or Fill Online. Under Michigan SalesUse Tax Statutes a casual seller ie not a licensed new or used vehicle dealer is not responsible for collecting and remitting sales tax on the sale of a used motor vehicle.

Do not let a buyer tell you that you are supposed to. If you own a car whether you purchased it new from a dealer or used from a private seller theres a 99 chance that you are liable to pay taxes when buying a car. Private vehicle transactions in Michigan require a 6 tax due on the full purchase price or fair market value of the vehicle whichever is greater.

If you decide to purchase your new car from a private seller in another state your home state will collect the necessary sales tax once you register the vehicle. You also have to pay tax when you sell a car whether you sell it to a person or a faceless corporation. However the new law eliminates that option so your only choice.

In the vast majority of circumstances selling your old car to a private party or to a dealer shouldnt bring a tax bill with it. When you visit your local Department of Motor Vehicles DMV you will need to produce the out-of-state title and the bill of sale from the seller. As of publication you wont pay any gift tax or file a gift tax return as long as the cars market value is 15000 or lessIf your cars value goes over that amount youll be liable for a tax on the difference between the market value and the annual exclusion.

However if you sell it for a profit higher than the original purchase price or what is. Either way tack on an additional 10 service charge on top of the fee. Who Pays Sales Tax When Selling A Car Privately In Michigan at Tax.

The average sales tax rate on vehicle purchases in the United States is around 487. If the final determination of tax liability differs from the amount collected when the title is transferred the purchaser must pay the difference plus interest and. Before the Tax Cuts and Jobs Act you could trade a business vehicle tax-free under Section 1030.

You will pay it to your states DMV when you register the vehicle. Indiana residents who purchased a vehicle from a. If you sell it for less than the original purchase price its considered a capital loss.

Proof of Sale Once a car is sold between parties in Michigan the seller is protected from any damages caused by the. These are two different types of transactions when it comes to paying the sales tax. Tax owed on all vehicle transfers.

That tax rate is 725 plus local tax. No taxes are due if you purchase or acquire a vehicle from an immediate family member. This means you do not have to report it on your tax return.

The most expensive standard sales tax rate on car purchases in general is found in California. Out-of-State Title Transfers in Michigan After Buying or Selling a Vehicle. If a vehicle is purchased from an Indiana dealership the dealer will collect the sales tax and provide proof of the sales tax paid on an ST108 Certificate of Gross Retail or Use Tax Paid State Form 48842.

In addition to taxes car purchases in Michigan may be subject to other fees like registration title and plate fees. The Michigan Department of Treasury administers the collection of the tax. In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Instead the buyer is subject to Michigan use tax when registering the title with the Michigan Secretary of State office. The tax on the transfer of a vehicle is 6 percent on the greater of the purchase price or the retail value of the vehicle at the time of transfer. The buyer must pay any sales taxes when the new title is applied for or provide proof that the sales taxes have been paid.

The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the. How Much is the Average Sales Tax Rate on Cars. If you are buying or selling a car for the first time you may be unaware of how taxes are paid for this type of transaction.

Find out more about the out of state car title transfer process in Michigan today. Michigan collects a 6 state sales tax rate on the purchase of all vehicles. The buyer will have to pay the sales tax when they get the car registered under their name.

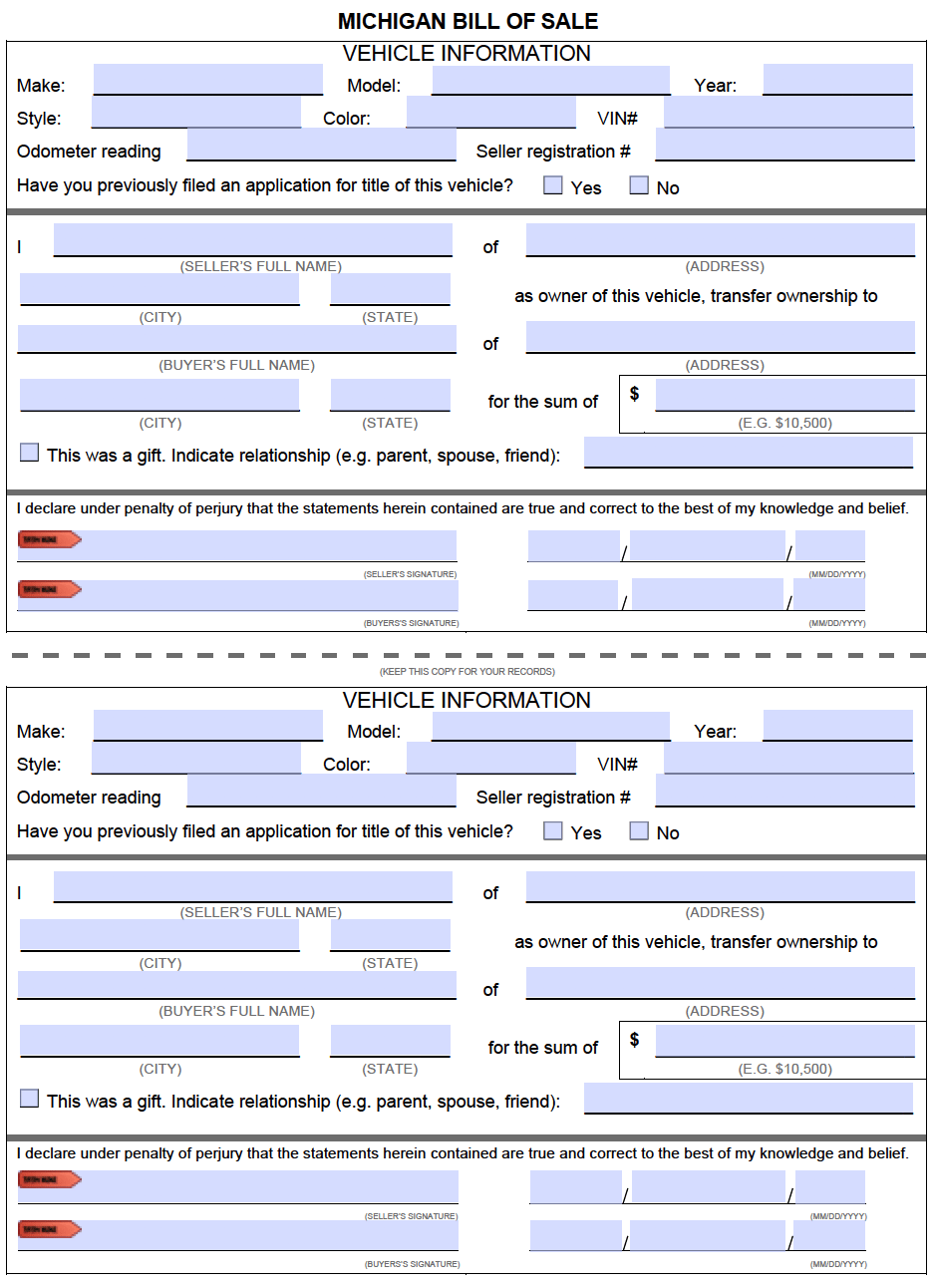

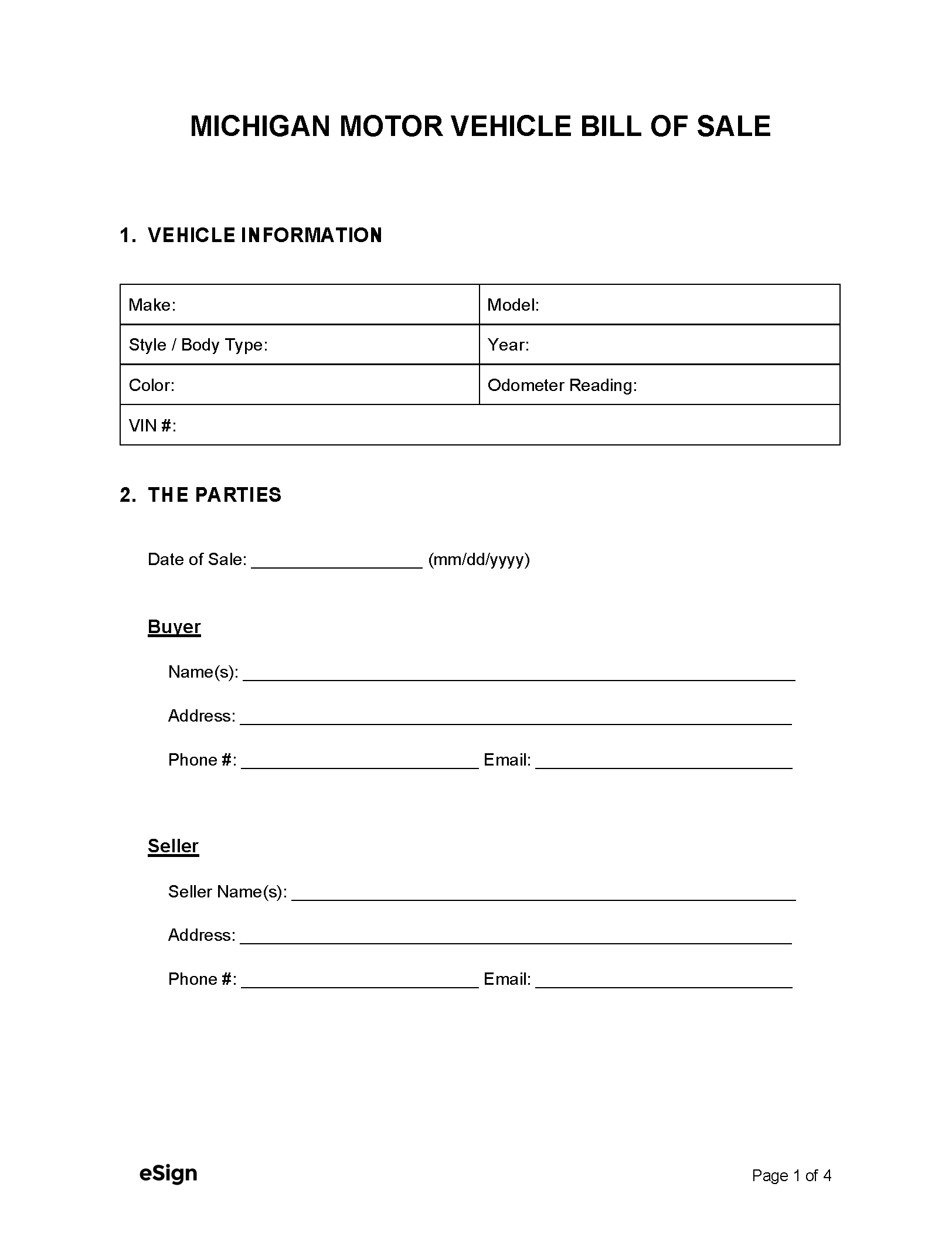

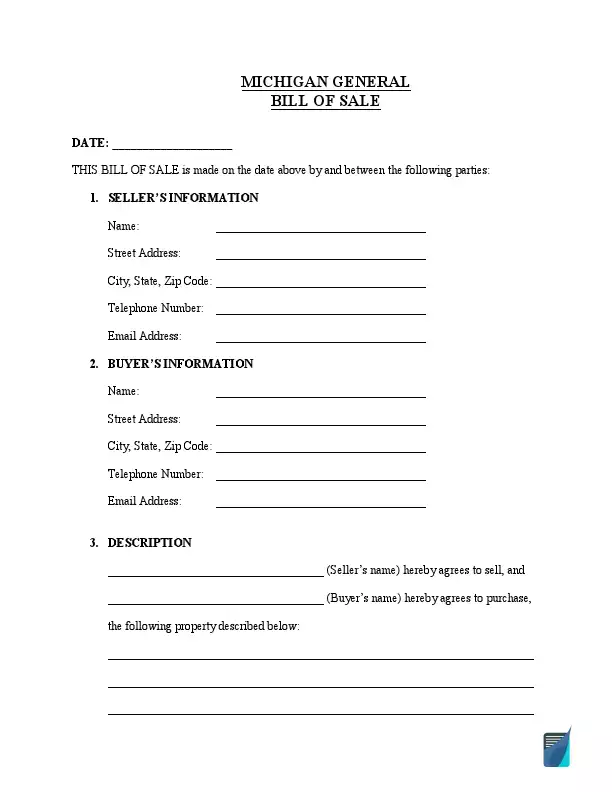

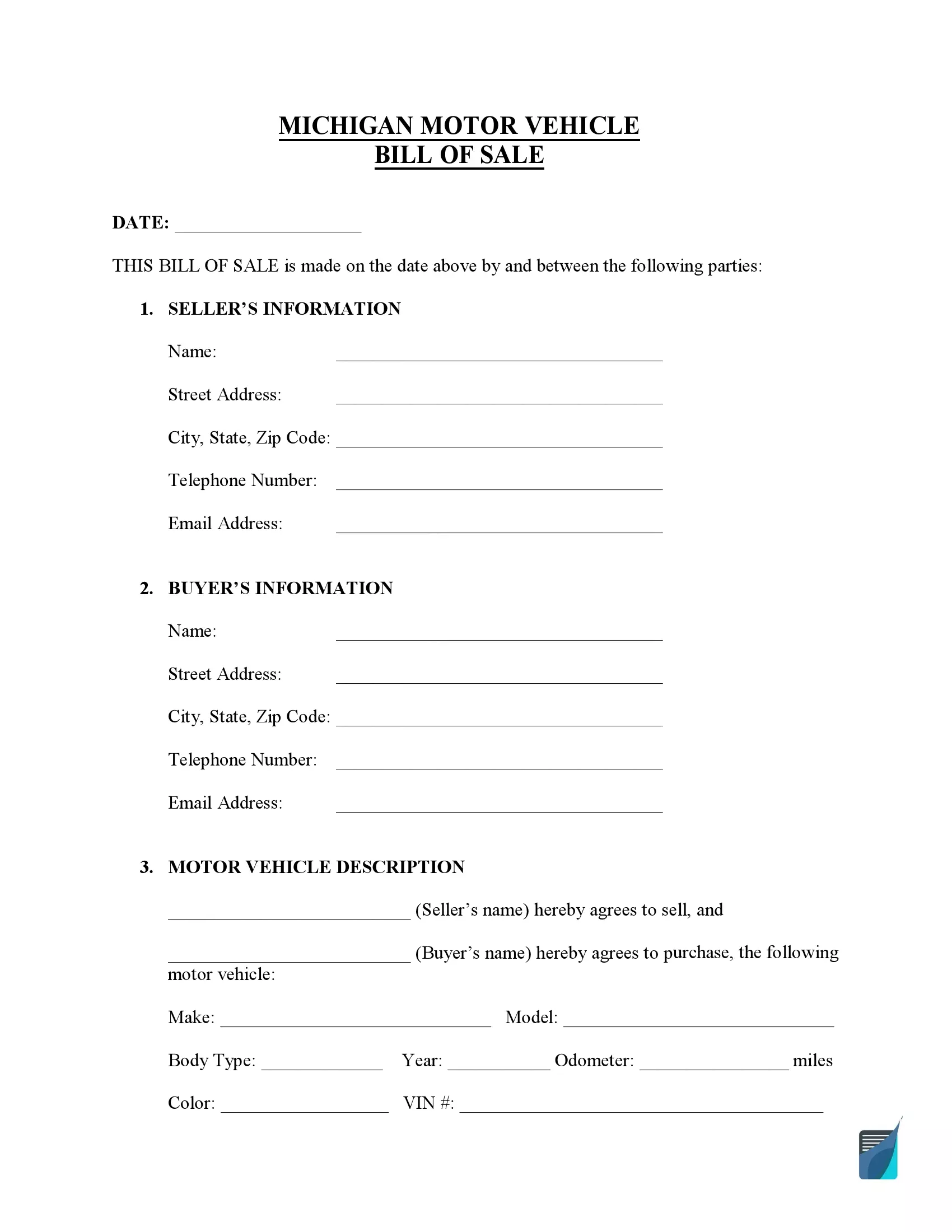

Free Michigan Bill Of Sale Forms Pdf Word

Free Michigan Bill Of Sale Forms Mi Bill Of Sale Templates

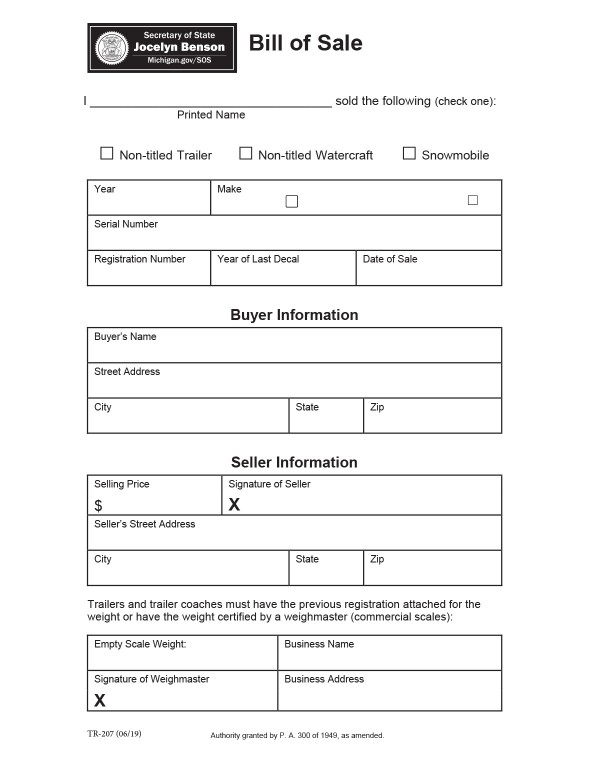

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

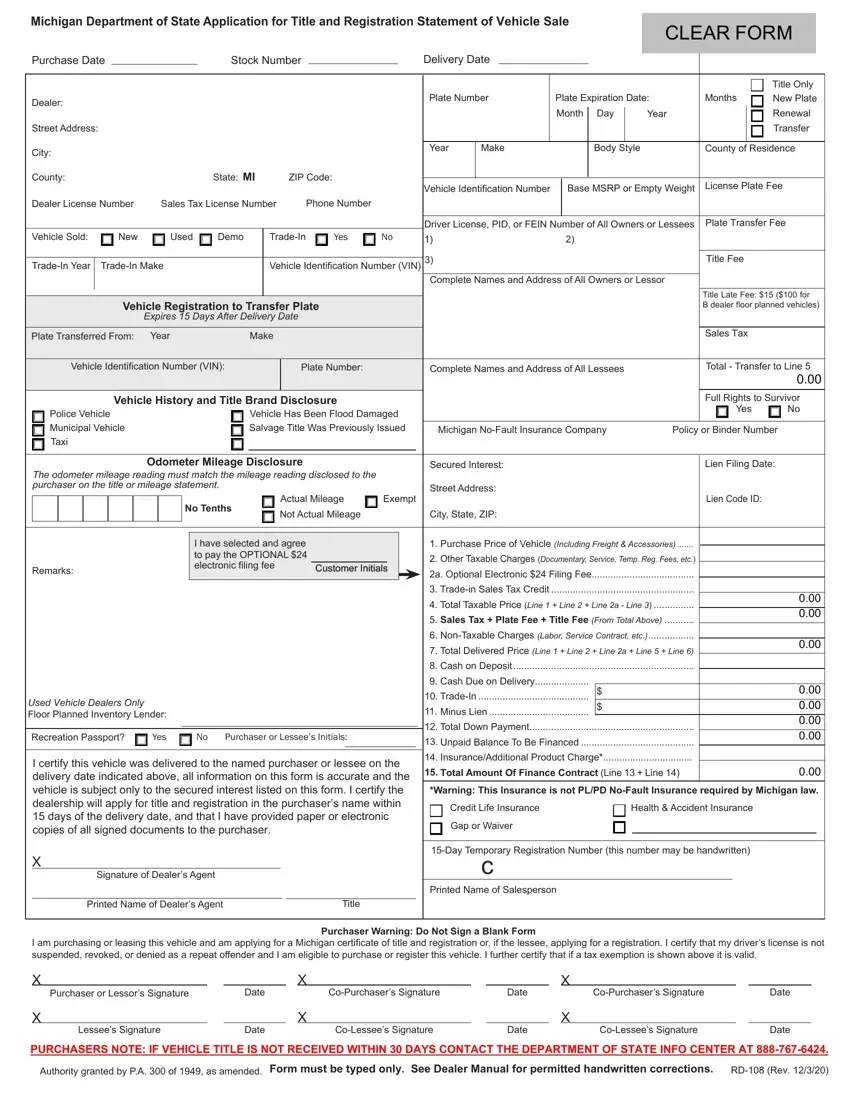

How To Transfer A Car Title In Michigan Yourmechanic Advice

Michigan Sales Tax Small Business Guide Truic

Free Michigan Bill Of Sale Forms Mi Bill Of Sale Templates

![]()

Free Michigan Bill Of Sale Forms Pdf Word

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Free Michigan Bill Of Sale Form Pdf Template Legaltemplates

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

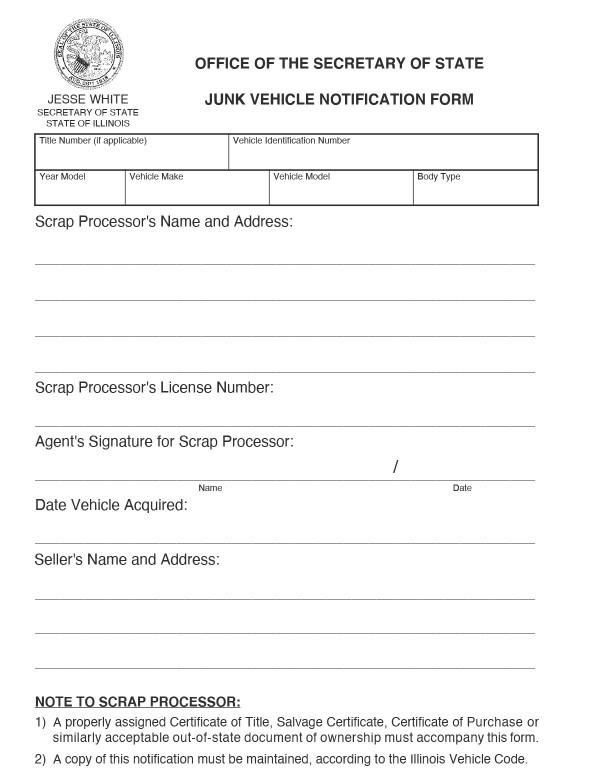

Michigan Bill Of Sale Forms Information You Need To Create A Bill Of Sale

Michigan Category Weight Fill Out Printable Pdf Forms Online

Michigan Bill Of Sale Forms Information You Need To Create A Bill Of Sale

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

How To Sell A Car In Michigan What The Sos Needs From Sellers

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Bill Of Sale Michigan Form Fill Out And Sign Printable Pdf Template Signnow